The special edition of the 40th HKTDC Hong Kong Watch & Clock Fair and 9th Salon de TE, organised by the Hong Kong Trade Development Council (HKTDC), Hong Kong Watch Manufacturers Association and the Federation of Hong Kong Watch Trades and Industries, took place in September 2021. After migrating and consolidating online with other fairs in 2020, the 2021 Fairs ran in both physical and online formats for the first time.

In order to get up to speed with the industry’s view of current and future market prospects, including new product trends and the latest e‑tailing developments, the HKTDC conducted face‑to‑face interviews with 384 buyers and 163 exhibitors at the 2021 Fairs.

The results showed an optimistic atmosphere among both buyers and exhibitors, who are anticipating an increase in sales in 2022. Market players are placing high hopes in the recovery in purchasing power, the e‑commerce spree and the potential growth of demand for smart and sports watches – factors they believe can counter the unabating uncertainty in the global economy caused by the Covid-19 pandemic, and the continued presence of lingering supply bottlenecks.

Tomorrow Is Another Day

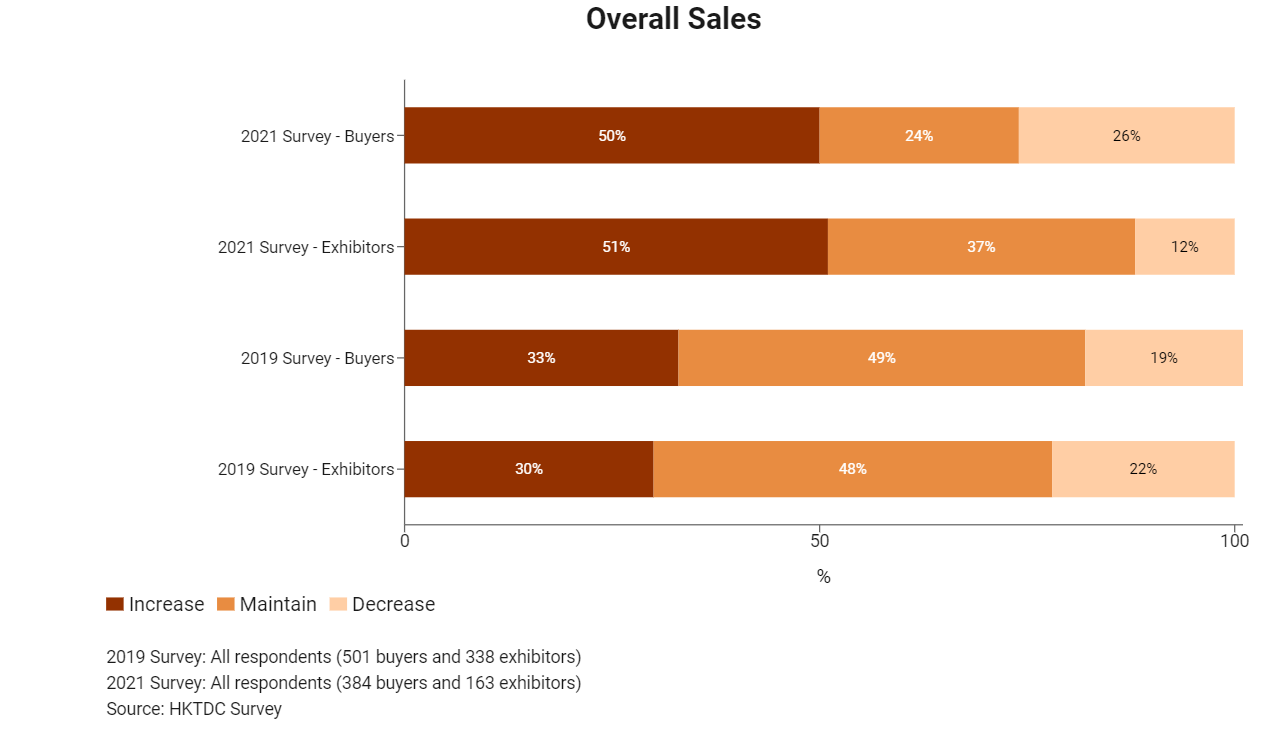

Half of the respondents expected overall sales to grow in 2022, with buyers predicting a growth rate of 23% on average, and exhibitors forecasting 30%. Only one‑third of those who responded the last time this survey was carried out in 2019 anticipated growth then.

With retail and FOB selling prices projected to remain at current levels, this expected sales increase is likely to be a result of a resurgence of demand. 45% of buyers and 55% of exhibitors thought prices would stay at their current levels (although those shares have decreased slightly from the 2019 survey). It is worth noting that there has been an increase in buyers expecting a decrease in retail price in 2022 (from 7% in 2019 survey to 21% now). 59% of buyers and 71% of exhibitors anticipated a rise in sourcing/production prices in the year ahead.

Opportunities amid Chaos

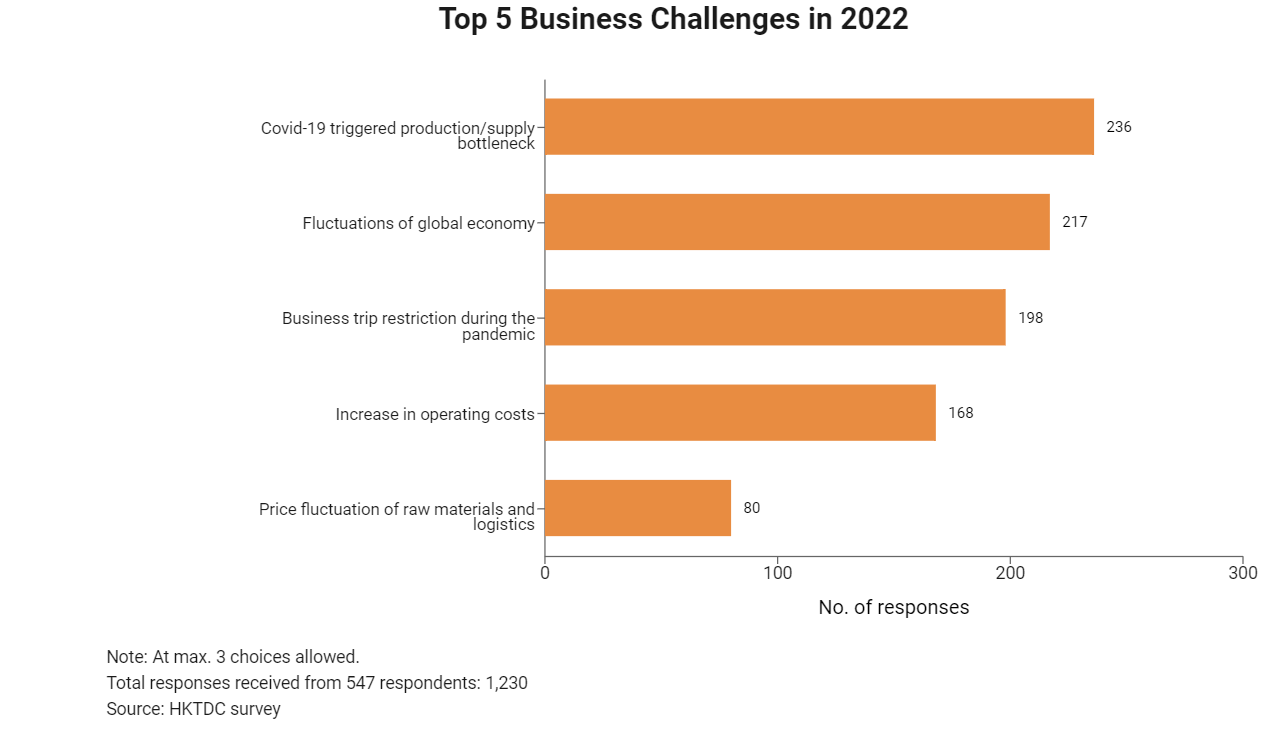

The impacts of Covid-19 are expected to continue to affect the market in 2022. Supply chain bottlenecks have been driving up logistics costs and thus having a negative effect on business planning since the onset of the crisis. This remains the biggest challenge ahead, followed by the global economic turbulence.

Out of a total of 1,230 responses picking out the three biggest business challenges in 2022, 236 indicated that supply chain bottlenecks would cause problems. It was the option selected by 43.1% of all buyers and exhibitors, and accounted for nearly 20% of all the options chosen. 217 responses indicated that fluctuations in the global economy were a grave concern, an option selected by 40% of respondents and representing about 18% of all responses.

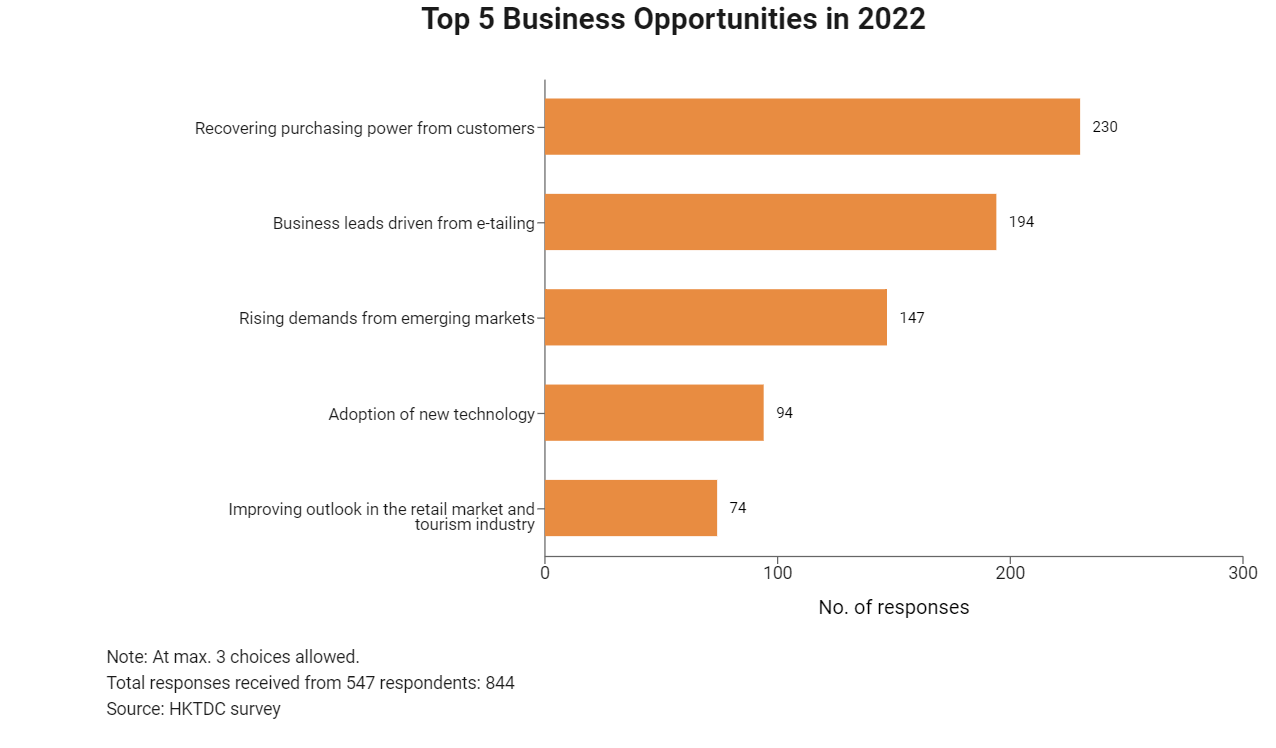

When asked what the most promising aspects were for business in 2022, most respondents said a rebound in demand rebound is expected to be the main driving force. E‑tailing is also expected to play a more pivotal role. Of the 547 respondents (who made 844 choices between them), 230 selected the recovery in purchasing power as the main business opportunity (a figure representing 42% of respondents and 27% of the responses). 194 respondents (35% of respondents and 23% of responses) saw e‑tailing leading business growth in the coming year.

Smarter Times

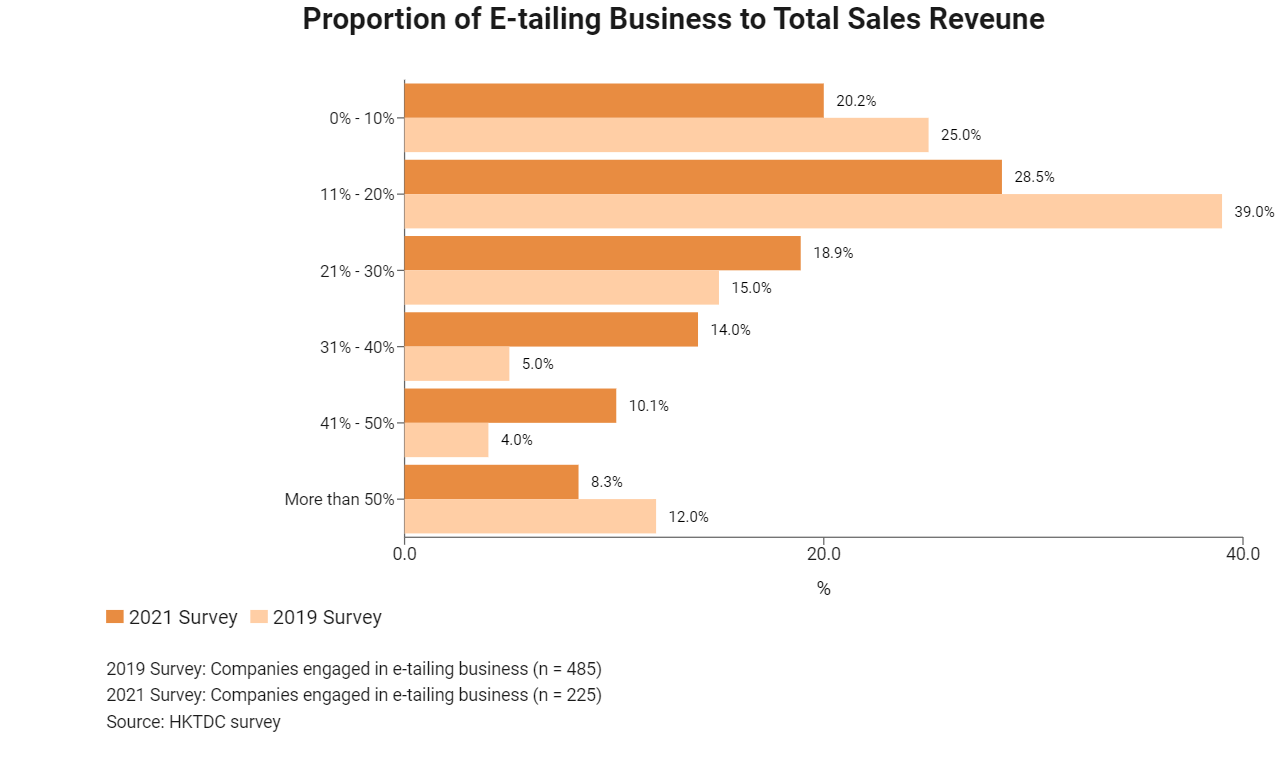

Digital sales channels had been playing a more proactive role in business even before the global Covid-19 pandemic, and the rapid rise in the popularity of digital will continue to prevail in 2022. In this year’s survey, 225 out of 547 respondents said they were engaged in e‑tailing businesses, although their average proportion of total sales accounted for by e‑tailing was only 26%. More than half of the respondents indicated that e‑tailing accounted for at least 20% of their total sales revenue. This compared well with the last survey when less than 40% of respondents said that their e‑tail/total revenue ratio was higher than 20%.

About 50% of those who have not yet started any digital businesses are expecting to follow suit in the next two years, compared to merely 27% expecting to do so in the 2019 survey.

Smart and Sports Watches

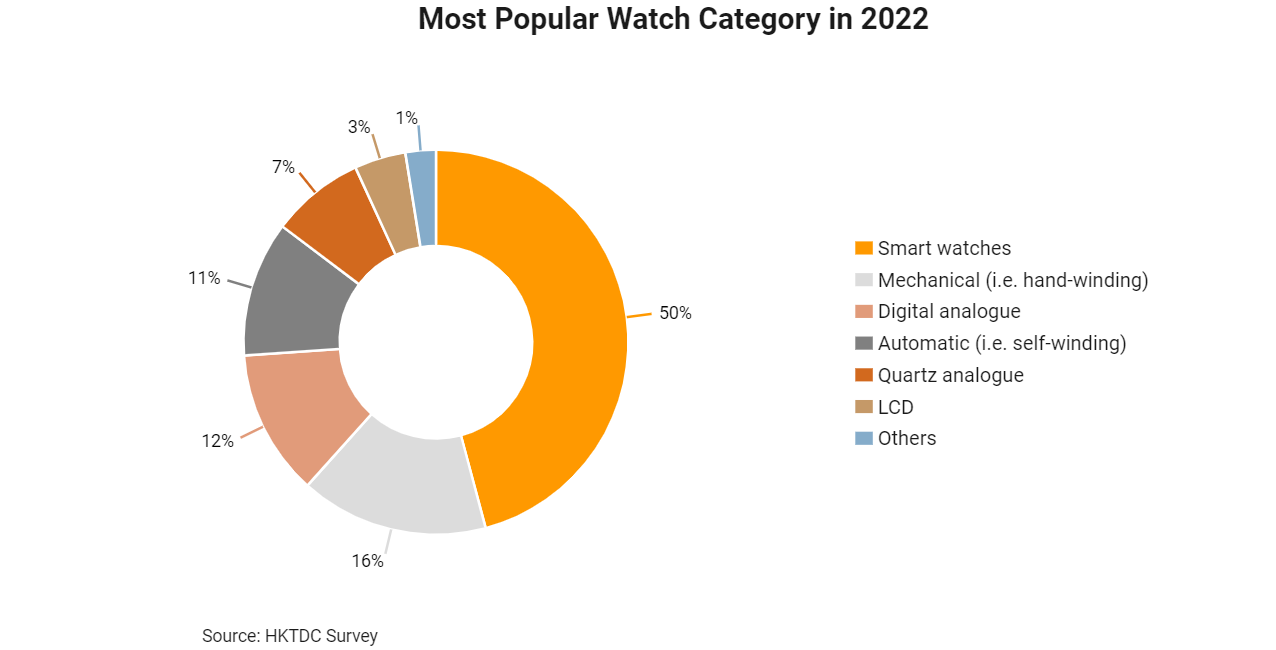

Smart watches will continue to be the most popular watch category in 2022. Half of the respondents (52% of buyers and 45% of exhibitors) said they believed it would take the lead in the market next year, while less than one‑third said the same in the 2019 survey.

Following smart watches are mechanical watches (selected by 16% of respondents), a market segment with higher expectations now than in 2019, particularly among the exhibitors (26% of exhibitors picked it out in 2021, compared to just 4% in 2019).

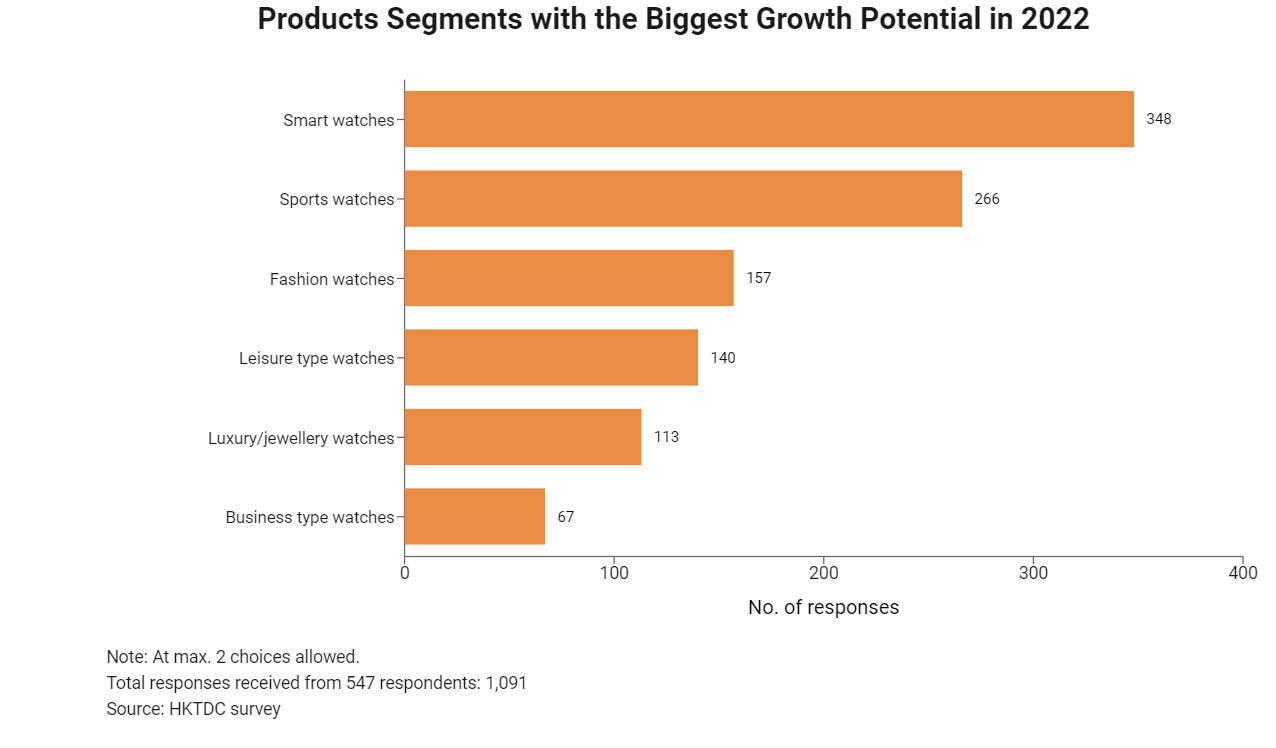

When asked about the two product segments with the highest growth potential, respondents have shifted their focus from fashion and leisure watches to smart watches and sports watches. Respondents were allowed to choose up to two market segments when answering this question, and so a total of 1,091 responses were received.

348 respondents forecast that smart watches have the biggest growth potential in the next 12 months. That figure represents 64% of all respondents ‑ up from 38% in the 2019 survey ‑ and 32% of all their choices. On average, respondents predicted a growth rate of 29% (a leap from 12% in the last survey).

Sports watches followed with 49% of respondents (a figure that represents 24% of all responses) seeing it to be a rising star in 2022up from the 26% who did so in the last survey. On average, they expected its rate of growth to be higher than 25%, a large rise from 11% in 2019.

Although smart watches and sports watches are considered to have the greatest potential, the industry is more optimistic now than it was in 2019 about the growth prospects of all segments in the coming year. In the 2019 survey, expected growth rates of all segments were around 10%, but now the average expected growth rate of each segment for 2022 is at least 22%.

rofile of Respondents

Some 509 of the 547 respondents (around 93% of the total) were based in Hong Kong. Of the remaining 38, 18% were from mainland China and another 18% were from Australia, while India, Japan, the UK and the US each accounted for 8%.

Pages you might like

Pages you might like

Latest information

Latest information

Follow official account

Follow official account

Online support

Online support

鄂ICP备2022017323号

鄂ICP备2022017323号

鄂公网安备 42018502006493

鄂公网安备 42018502006493

Launch Exhibition

Launch Exhibition

Release information

Release information

Today's topic

Today's topic