At the Food Entrepreneurship Forum of the first online forum of FBIF on December 25, 2022, Curt Ferguson, managing partner of Ventech China, gave a keynote speech on "How to inject the winning spirit of 'Coca-Cola' into emerging Chinese brands."

Curt Ferguson, Managing Partner, Ventech China

Curt joined Ventech China as a managing partner in 2021, and together with Eric Huet and James Jin, he led Ventech China's investments in consumer markets, financial technology and big data, focusing on the fast-growing Chinese consumer class.

Curt worked at Coca-Cola for 38 years and has been the head of Coca-Cola Greater China, Korea and Outer Mongolia since 2016. This business covers 1.7 billion people in the region, directly employs 51,000 employees, and brings more than 500,000 additional jobs.

After Curt successfully promoted the franchise management model and established a stronger dual-bottler franchise system in China, he made this business unit the fastest growing market for Coca-Cola. Coca-Cola Greater China and Korea stood out from all business units and was shortlisted for the Woodruff Cup Best Business Award in 2018 and 2019.

We have compiled Curt's sharing content below for your reference.

It's great to see you all, although we can only meet online this year. I have always liked the FBIF Food and Beverage Innovation Forum very much. Last year (2021), the offline forum in Hangzhou left a deep impression on me. There are both large-scale projects of well-known brands and cutting-edge creativity of young brands. I believe that these brands are embodying the huge potential of China in the future. I would also like to draw out the main point of my speech today: development is never a straight line, and there will still be twists and turns on the road ahead. However, we have seen positive signs, and the business world now and in the future will be particularly worth looking forward to. We will start with multinational companies represented by Coca-Cola, and then extend to start-ups and our expectations for the future.

First, let me briefly introduce myself. I started my career at Procter & Gamble in the traditional consumer goods industry, and then joined Coca-Cola. Later, I have been working at Coca-Cola for 38 years. Many people may think that entering a company like Coca-Cola is like driving a Tesla. You just need to get in the car, start it, and then drive forward. But in fact, it is not. Many times you have to open up a path yourself. Although this process is difficult, it is very rewarding. This is a wonderful career journey. It is not smooth sailing and will also experience a certain downturn. But in fact, when you explore different areas, even just within your own company, you will make your capabilities more comprehensive. I still feel very lucky for my experience of personally participating in different markets and contacting different consumers.

The Chinese market also has its own uniqueness. For example, group buying, which has developed in China, can be said to be unreplicable anywhere else in the world. Now at this moment of optimized epidemic prevention and control measures, China's economy is about to rebound strongly. Brands that can only do superficial work will gradually give way to those that can make real promises to consumers and can truly interact with consumers. Using the information industry as an example, Chinese consumers are no longer in the "5G" era, they have entered the "6G" or even "7G" era. They have a very deep understanding of brands, companies, products, etc. Such consumer groups are extremely rare in the world.

Back to the topic of Coca-Cola, why is Coca-Cola so successful and continues to maintain its success? Coca-Cola's success comes from its efficient and large-scale operations; from its effective control of prices so that everyone can afford it; from its continuous investment in the market to make it a national brand; and from its business model supported by economies of scale and objective profit margins.

About a can of Coca-Cola

In China today, it is easy to come up with an idea and find a partner to start a business together. What is really difficult is to maintain a brand. What if a competitor comes in? What if there is a problem with the supply chain? How to iterate the idea to make the brand more successful? How to communicate with consumers to establish brand promises? These are not easy tasks.

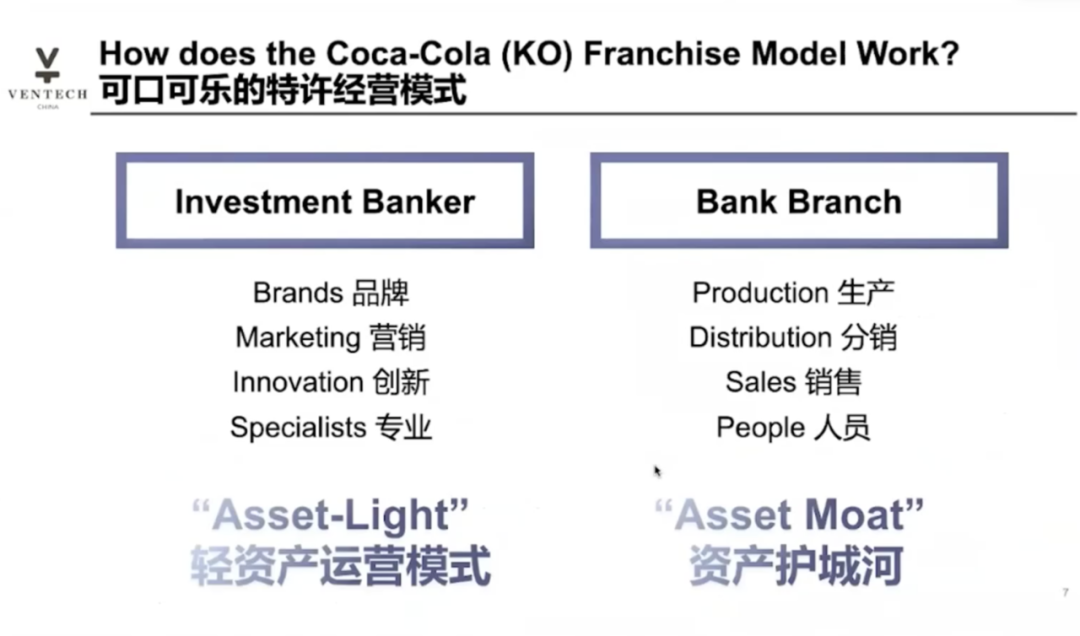

Another reason for Coca-Cola's success is its "franchise model". In this model, the parent company of Coca-Cola is equivalent to a professional investment institution, focusing on brand, marketing, innovation, professional talents and other aspects. This is a truly strict "duty delegation". Local franchise companies include Swire, COFCO and other companies. These local companies are very familiar with the local business and environment in China, and they complete the production, distribution, sales and other links that require a lot of manpower. At present, Coca-Cola has about 500 employees in China, but local franchise companies have 51 factories and more than 50,000 employees. This franchise model is very similar to the operating methods of McDonald's and Yum China, allowing the brand to penetrate the local market on a large scale in a short period of time.

Coca-Cola's franchise model

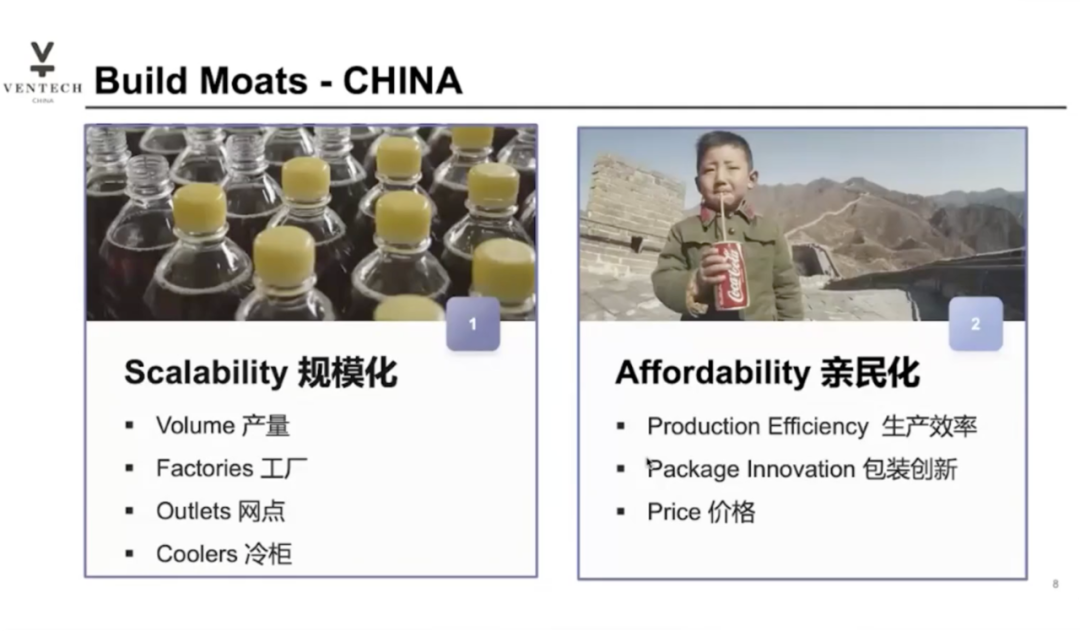

As we all know, Warren Buffett is one of the largest shareholders of Coca-Cola. He has said many times that he only invests in "companies with moats." Coca-Cola has also built its own moat over the years of development.

Coca-Cola's moat

The first moat is scale. A bottle of Coke, with such a complex industrial chain behind it, can be sold for only 3 yuan and still make a profit. This can only be achieved by using the scale effect.

The second moat is its popularity. The large-scale production mentioned above allows Coca-Cola to keep its price very affordable, thus forming a scale cycle. Moreover, Coca-Cola has maintained this model for more than 100 years and has been in the Chinese market for more than 40 years.

We often hear some brands say "I want to be the next Coca-Cola". This is a good expectation, but it may not be a good business model for them. I think they should figure out how to sell their products at a price far higher than 3 yuan so that Chinese consumers will recognize and be willing to pay this premium. Many startups want to chase some companies that have existed for many years. This goal itself is fine, but these companies must have their reasons for existing for many years. Don't think that you can rush in directly with a good idea. As a result, you dive into the moat of these old companies and ultimately lack the motivation to achieve commercial success.

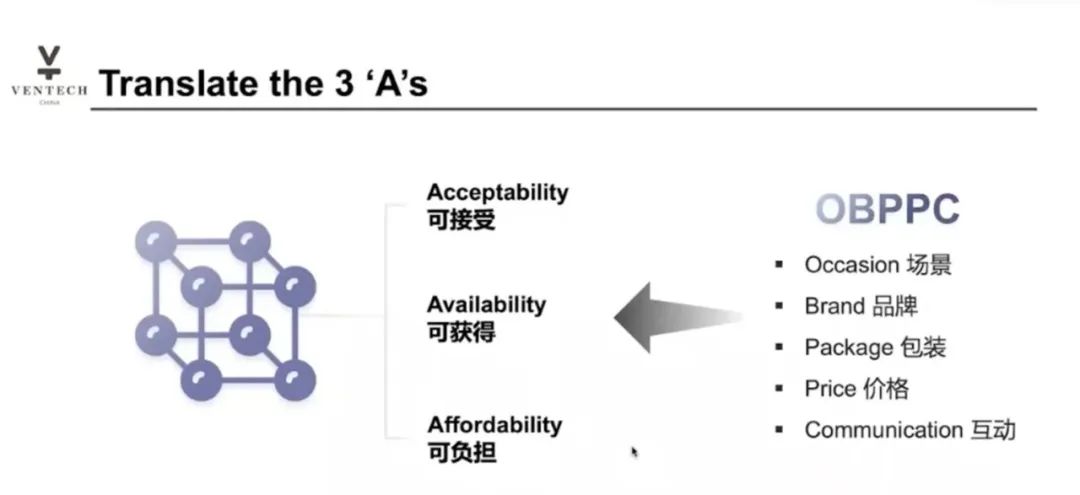

So how to do it specifically? Every excellent brand has its own way to win the market, and the brand must define it clearly. For more than 100 years, Coca-Cola's approach has been based on the "Triple A Principle" - Acceptable, Available and Affordable.

Coca-Cola 3A principles

Acceptable means being a brand that everyone accepts, likes, brings value to consumers, and benefits from; accessible means that everyone can get Coca-Cola conveniently from anywhere; affordable means that the price of the product is affordable for anyone.

This is worth thinking about for every brand: What strategy do I plan to use to attack the market I want to focus on? How should I define them? What is different about this market? And continue to ask these questions: What is the consumption scenario? When do people use this product? What kind of brand is most suitable for your product and close to the usage scenario? What kind of packaging is needed to meet this target price?

Take the beverage industry as an example. Obviously, the products people drink in the morning, when they go out, and when they watch a movie will definitely be different. At this point, the "OBPPC" principle of products, namely "occasion", "brand", "package", "price", and "communication", basically applies to any brand and any product. If you don't think about these clearly, your promotion budget may be spent on completely ineffective scenarios. For example, I have seen many times that some brands promote products that do not belong to this time period in the morning.

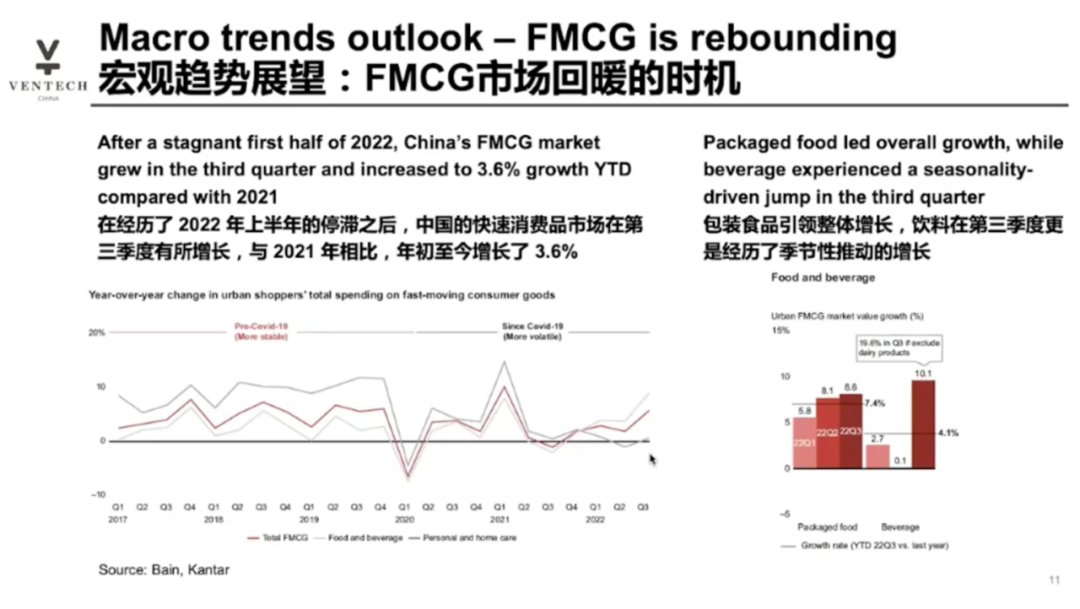

Today, the overall background of the epidemic is improving, many people are relieved, and everyone has restored the freedom of travel. I believe that Chinese consumers will soon find their way. In fact, the rebound has begun, the fast-moving consumer goods industry has returned to growth, and the packaged food field that everyone is concerned about has also rebounded significantly, with a growth rate of nearly 9% in the third quarter. You know, this was achieved in the third quarter when the epidemic restrictions were not completely lifted.

Macro market outlook

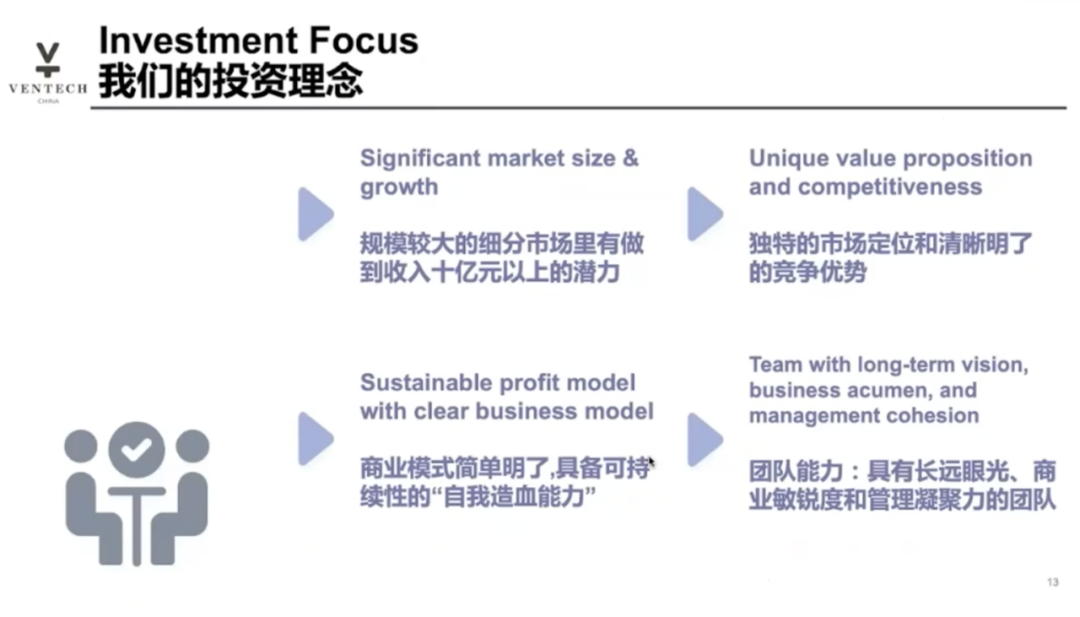

The last part is our philosophy on investment. What we do is work backwards from the consumer side to evaluate the consumer market. Does this market have growth potential? Is there a unique value proposition? What is the competitive environment like? In the end, it will come back to what we said before: Can the brand develop sustainable profitability? We pay more attention to what can make money in an idea. At the same time, we will also evaluate the founders, what is the background of the team? What is their long-term vision? Do they have relevant experience before? Do the team members know each other? Do they complement each other? The team and creativity are equally important. We need to ensure that the team has enough perseverance and endurance to advance the project.

Ventech's Investment Theory

Finally, let me share with you some market changes and companies we have invested in. First, Keep, which is very familiar to everyone. Ventech is one of Keep's initial investors. We found that as consumers gradually upgrade in the consumption chain, they are more affluent, want to be healthier, and prefer to customize their workouts according to their own time and needs. They need a "personal trainer on their phone", and Keep can meet their needs. At the same time, Keep is already exploring their next needs, such as high-protein snacks.

Ventech's Investment Case

We also invested in a food company, POP MEALS, which is a fast food chain brand in Southeast Asia, a bit like the American food trucks that everyone is familiar with. We have also begun to make some attempts to promote this model to the Chinese market.

Finally, there is Xianmu Farm, which is a light catering supply chain. When we focus on the coffee or milk tea industry, we don’t have to invest directly in a brand, we can also be their suppliers. The B2B world is equally interesting and full of opportunities.

The above is all the content of this sharing. Finally, I want to say that the speed of economic rebound in the future will be surprisingly fast, and the opportunity is right in front of us. We are always optimistic about China and Chinese companies. I look forward to meeting you offline at the next FBIF forum!

Source of the picture in this article: Ventech

Source of the cover picture of this article: Ventech

This article is reproduced from the FBIF Food and Beverage Innovation Exhibition

Follow official account

Follow official account

Online support

Online support

鄂ICP备2022017323号

鄂ICP备2022017323号

鄂公网安备 42018502006493

鄂公网安备 42018502006493